Hover Day’s Picks: Best 5 No Credit Check Loan Providers with Guaranteed Approval in 2025

/EIN News/ -- DALLAS, May 03, 2025 (GLOBE NEWSWIRE) -- No credit check loans guaranteed approval direct lender options have become essential financial solutions for individuals with poor credit histories. In 2025, specialized lending services are able to bypass traditional credit verification processes, offering immediate funds to borrowers regardless of their credit scores. No credit check loans direct lenders operate independently from banks, with application processes and faster approval times for those facing financial emergencies.

Best 5 No Credit Check Loan Providers with Guaranteed Approval in 2025

Hover Day has partnered with these providers in the past to develop and optimize their websites, and further information about them can be found below.

- PaydayDaze offers fast solutions for those seeking no credit check loans guaranteed approval direct lender services, with same-day funding options and simplified application processes designed for borrowers with poor credit history.

- GreendayOnline provides flexible terms for no credit check loans guaranteed approval online with competitive rates and minimal documentation requirements, making emergency funds accessible to those with limited credit options.

- PaydayPeek’s streamlined platform specializes in no credit check loans online guaranteed approval with quick decision times and funds deposited directly to your bank account, often within 24 hours of application submission.

- PaydayChampion features extended repayment options for no credit check installment loans guaranteed approval direct lender services, allowing borrowers to manage their debt with structured payment plans tailored to their financial situation.

-

PaydayPact connects borrowers with a network of lenders offering no credit check loans guaranteed approval direct lender online solutions, increasing approval chances even for those with bankruptcy or previous loan defaults.

For those seeking quick financial relief, online no credit check loans offer convenience through digital platforms accessible 24/7. Instant loans online guaranteed approval services deliver funds within hours of application submission, addressing urgent monetary needs without delay. While guaranteed approval loans no credit check promise universal acceptance, borrowers must verify terms before committing to avoid excessive interest rates. The most legit online loans guaranteed approval providers maintain transparency about fees and repayment schedules, ensuring borrowers understand their obligations. No credit check loans guaranteed approval services will require proof of income and valid identification despite omitting credit history reviews.

Top 5 No Credit Check Loans Guaranteed Approval Direct Lender Options for Financial Emergencies

My research into the 2025 lending landscape reveals several viable options for borrowers needing quick funds without traditional credit requirements.

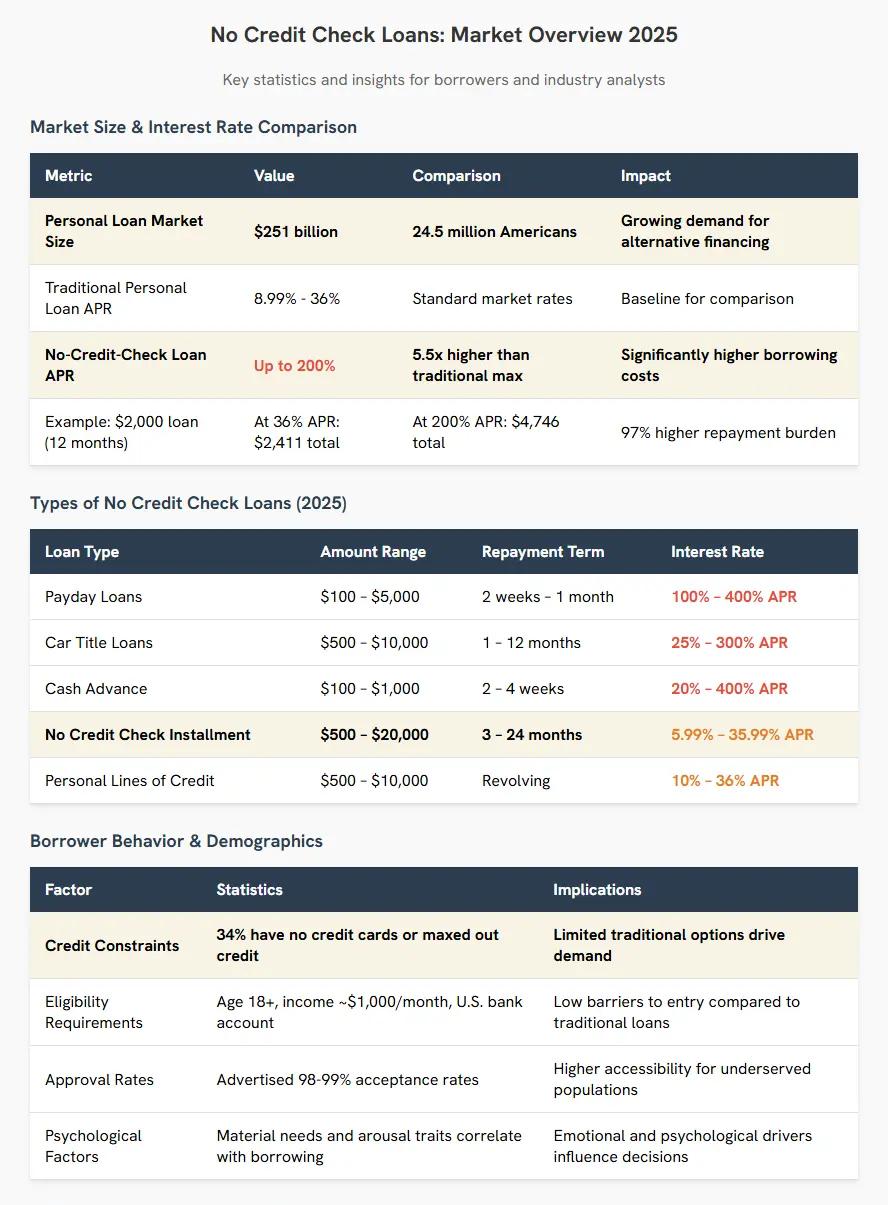

According to recent data, more than 24.5 million Americans collectively owe $251 billion in personal loans, including no-credit-check and bad credit loans, demonstrating the significant demand for these financial products in today’s market (source).

PaydayDaze: Leading Provider of No Credit Check Payday Loans Guaranteed Approval Online

PaydayDaze stands out as my top recommendation for no credit check payday loans with guaranteed approval online, offering loan amounts ranging from $100 to $5,000 with competitive rates compared to traditional payday lenders.

Borrowers appreciate PaydayDaze’s streamlined application process, which takes minutes to complete and requires minimal documentation for approval.

Financial emergencies don’t wait for perfect credit scores, and PaydayDaze understands this reality by focusing on income verification rather than credit history for loan decisions.

Repayment Options for Online Loans Direct Lenders

PaydayDaze provides flexible repayment options tailored to various financial situations, allowing borrowers to select terms that align with their income schedule and budgetary constraints.

- Single payment option for short-term loans ( 2-4 weeks)

- Bi-weekly installments synchronized with pay periods

- Monthly payment plans for larger loan amounts

- Early repayment without penalties or additional fees

Qualification Factors for No Credit Check Loans

Meeting PaydayDaze’s qualification requirements involves demonstrating financial stability through verifiable income rather than credit history, making these loans accessible to borrowers with damaged credit profiles.

- Minimum age requirement of 18 years

- Active checking account for at least 90 days

- Verifiable regular income of at least $1,000 monthly

- Valid government-issued ID and contact information

Disbursement Timeline for Fast Loans No Credit Check

PaydayDaze excels in rapid fund disbursement, with most approved borrowers receiving their money within one business day through direct deposit to their verified bank accounts.

Applications submitted before 11:30 AM receive same-day funding decisions, with funds often appearing in accounts by the next morning.

Weekend applications naturally experience slight delays due to banking hours, but PaydayDaze processes requests immediately on the next business day to minimize waiting times.

Pros and Cons of No Credit Check Online Loans

PaydayDaze offers significant advantages for borrowers needing immediate funds without credit checks, though potential borrowers should carefully consider both benefits and drawbacks before committing.

Pros:

- Guaranteed approval with income verification

- No hard credit check affecting credit scores

- Same-day or next-day funding availability

- Simple online application process

Cons:

- Higher interest rates compared to traditional loans

- Shorter repayment periods creating potential repayment pressure

- Maximum loan amounts lower than conventional personal loans

GreendayOnline: Best Online Loans Instant Approval with Flexible Terms

GreendayOnline distinguishes itself by offering exceptionally flexible loan terms for borrowers seeking no credit check loans with instant approval, accommodating various financial needs and repayment capabilities.

My analysis shows GreendayOnline’s approach focuses on creating sustainable borrowing experiences through customizable loan structures rather than one-size-fits-all products.

Research indicates that about half of Americans have credit scores that would disqualify them from most traditional loan products, making flexible alternatives like GreendayOnline increasingly important (source).

Repayment Options for Online Loans Without Credit Check

GreendayOnline stands out by offering multiple repayment structures designed to accommodate various financial situations and borrower preferences.

- Installment plans ranging from 3 to 24 months

- Bi-weekly payment options aligned with common pay schedules

- Flexible payment dates adjustable to borrower’s income timing

- Partial prepayment options reducing overall interest costs

Qualification Factors for No Credit Check Online Payday Loans

GreendayOnline maintains accessible qualification requirements focused on current financial stability rather than past credit history, making loans available to borrowers excluded from traditional lending.

- Proof of regular income (employment, benefits, or self-employment)

- Active bank account maintained for at least 60 days

- Valid contact information and identification

- Age requirement of 18+ years (21+ in some states)

Disbursement Timeline for Quick Loans Online No Credit Check

GreendayOnline prioritizes rapid fund delivery with most approved applications receiving funds within 24 hours of final approval, often sooner depending on banking relationships.

Applications completed and approved before 2:00 PM on weekdays frequently receive same-day funding through expedited ACH transfers to verified bank accounts.

Banking system limitations may occasionally extend disbursement times, but GreendayOnline’s commitment to quick funding remains consistent across all approved loans.

Pros and Cons of Loans No Credit Check Online

GreendayOnline’s lending model offers distinct advantages for borrowers seeking flexible no credit check loans, though important considerations exist regarding costs and terms.

Pros:

- Highly customizable loan terms up to 24 months

- Transparent fee structure without hidden charges

- User-friendly online account management

- Consideration of alternative income sources beyond traditional employment

Cons:

- APRs ranging from 5.99% to 35.99%, higher than traditional bank loans

- Potential for loan renewal fees if unable to repay on schedule

- State restrictions limiting availability in certain regions

PaydayPeek: Online Loans For Bad Credit Guaranteed Approval with Same-Day Processing

PaydayPeek excels in providing online loans for bad credit with guaranteed approval through their same-day processing system, making funds available quickly for urgent financial needs.

My examination of PaydayPeek reveals a streamlined operation designed specifically for speed without sacrificing necessary verification steps, balancing accessibility with responsible lending practices.

Financial data shows that borrowers who seek no credit check loans for bad credit with guaranteed approval are often credit-constrained, with studies showing that a majority have less than $400 in available credit card liquidity when taking out a payday loan, highlighting the critical need for services like PaydayPeek (source).

Repayment Options for No Credit Check Loans Online

PaydayPeek provides straightforward repayment structures designed for clarity and convenience, helping borrowers manage their loan obligations effectively.

- Standard 14-30 day repayment for smaller loan amounts

- Extended payment plans for larger loans (up to 3 months)

- Automatic payment options with schedule reminders

Qualification Factors for Online Loans No Credit Check

PaydayPeek maintains accessible qualification standards focused on current income stability rather than credit history, opening doors for borrowers with damaged credit profiles.

- Steady income source verified through recent pay stubs or statements

- Active checking account for direct deposit

- Valid phone number and email for verification

- Minimum monthly income of $800

Disbursement Timeline for Online Loans Instant Approval

PaydayPeek’s same-day processing system enables exceptionally quick fund disbursement, with approved loans often funded within hours of application completion.

Applications verified and approved before noon on business days frequently receive funds by 5:00 PM the same day through expedited processing channels.

PaydayPeek’s partnerships with multiple banks enable faster clearing of electronic transfers compared to many competitors, reducing waiting time for borrowers facing urgent financial needs.

Pros and Cons of Loans Online No Credit Check

PaydayPeek offers significant advantages for borrowers needing immediate funds without credit checks, though important considerations exist regarding costs and terms.

Pros:

- True same-day funding for many approved applications

- Minimal documentation requirements

- Mobile-friendly application process

- No prepayment penalties

Cons:

- Higher APRs for very short-term loans

- Lower maximum loan amounts than some competitors

- Limited availability in certain states due to regulations

PaydayChampion: Bad Credit Personal Loans Guaranteed Approval Direct Lenders with Extended Terms

PaydayChampion specializes in bad credit personal loans with guaranteed approval from direct lenders, offering extended terms that provide breathing room for borrowers needing more time to repay.

My research into PaydayChampion reveals a focus on sustainable lending practices through longer repayment periods and more manageable installment structures compared to traditional payday products.

PaydayChampion’s extended terms help borrowers avoid the debt cycles common with short-term loans, where high costs and brief repayment windows often lead to repeated borrowing.

Repayment Options for No Denial Payday Loans Direct Lenders Only No Credit Check

PaydayChampion offers diverse repayment structures designed to accommodate various financial situations and borrower preferences.

- Extended installment plans from 3 to 36 months

- Bi-weekly or monthly payment schedules

- Graduated payment options with smaller initial payments

- Refinancing opportunities for qualifying borrowers

Qualification Factors for Easy Approval Installment Loans For Bad Credit Direct Lenders

PaydayChampion maintains reasonable qualification requirements focused on income stability and basic financial verification rather than credit scores.

- Verifiable income source (employment, benefits, or self-employment)

- Active bank account for at least 30 days

- Valid government ID and proof of residence

- Age requirement of 18+ years

Disbursement Timeline for Direct Lender Online Loans

PaydayChampion processes applications quickly with most approved loans funded within one business day, balancing speed with necessary verification procedures.

Applications completed and verified before 3:00 PM on weekdays receive funding the following business day through direct deposit to the borrower’s verified bank account.

PaydayChampion’s direct lender model eliminates intermediaries, allowing for faster processing and more consistent funding timelines compared to broker or marketplace platforms.

Pros and Cons of High Risk Personal Loans Guaranteed Approval Direct Lenders

PaydayChampion offers significant advantages for borrowers seeking longer-term options without credit checks, though important considerations exist regarding qualification and costs.

Pros:

- Extended repayment terms up to 36 months

- Higher loan amounts available (up to $10,000)

- Direct lender relationship throughout the loan term

- Opportunity to build positive payment history

Cons:

- Stricter income verification than some competitors

- Potential for secured loan requirements for larger amounts

- Higher minimum loan amounts than typical payday products

PaydayPact: Personal Loans For Bad Credit Guaranteed Approval Online Through Lender Networks

PaydayPact operates as a comprehensive lender network connecting borrowers with personal loans for bad credit with guaranteed approval online, offering access to multiple lending options through a single application.

My evaluation of PaydayPact shows their network approach increases approval chances by simultaneously submitting applications to multiple compatible lenders based on borrower profiles.

PaydayPact’s extensive lender network includes both traditional installment lenders and alternative financing sources, creating more opportunities for borrowers with challenging credit situations.

Repayment Options for Direct Lender Online Installment Loans Instant Approval

PaydayPact’s network lenders offer varied repayment structures, with options determined by the specific lender matched to the borrower’s profile and needs.

- Short-term options from 14 days to 3 months

- Medium-term installment plans from 3 to 12 months

- Long-term structured repayment up to 60 months for larger loans

- Customized payment scheduling based on income frequency

Qualification Factors for Guaranteed Loans No Credit Check

PaydayPact maintains inclusive qualification standards designed to accommodate various financial situations while meeting basic verification requirements.

- Minimum monthly income of $1,000 from verifiable sources

- Active checking account for at least 60 days

- Valid contact information for verification

- US residency and legal age requirement

Disbursement Timeline for Easy Loans Online Approval

PaydayPact facilitates rapid funding through its network of lenders, with timelines varying based on the specific lender matched to the borrower’s application.

Applications processed through PaydayPact’s system receive initial responses within minutes, with complete funding often available within one business day after lender matching and final approval.

PaydayPact’s technology platform streamlines the matching process, reducing delays between application submission and lender approval decisions.

Pros and Cons of Guaranteed Approval Loans For Poor Credit

PaydayPact’s network model offers distinct advantages for borrowers seeking multiple options without repeated applications, though certain limitations exist compared to direct lender relationships.

Pros:

- Access to multiple lenders through one application

- Higher approval rates through lender matching technology

- Diverse loan products beyond standard payday options

- Educational resources for improving financial health

Cons:

- Potential for marketing communications from multiple lenders

- Variable terms depending on matched lender

- Less direct control over the specific lender selected

What Are No Credit Check Loans Online Instant Approval and How Do They Work?

No credit check loans with online instant approval are financial products designed to provide quick funds without requiring traditional credit score reviews, instead focusing on income verification and basic eligibility factors.

My research shows that no credit check loans online with instant approval work by evaluating current financial stability rather than past credit history, making decisions based on income documentation, employment verification, and basic personal information.

Lenders offering such products use alternative data points to assess risk, including banking history, income stability, and sometimes digital footprints or device information to determine creditworthiness without conventional credit reports.

Fintech innovations have significantly improved this process, with machine learning models using alternative data achieving strong predictive power for lending to individuals with no traditional credit score, as evidenced by an AUC (area under the ROC curve) of 0.752 in recent studies.

Step-by-Step Application Process for Payday Loans Online No Credit Check Instant Approval

Applying for payday loans online with no credit check and instant approval involves a streamlined process designed for speed and accessibility, completed entirely online without paperwork or in-person visits.

- Complete the online application form with personal information, income details, and banking information, ensuring accuracy to prevent delays in processing.

- Submit required documentation, usually including recent pay stubs, bank statements, government ID, and proof of active checking account, often through secure upload features.

- Receive instant preliminary approval based on automated verification systems, within minutes of application submission.

- Review and electronically sign the loan agreement, carefully examining terms, fees, and repayment schedule before accepting.

- Await final verification and fund disbursement, with money deposited directly to your bank account within one business day.

Types of Personal Loans No Credit Check Instant Approval Available in 2025

Personal loans with no credit check and instant approval have evolved significantly by 2025, offering diverse options to meet various financial needs and situations beyond traditional payday products.

- Payday Loans: Short-term, small-dollar loans due on the borrower’s next payday, ranging from $100-$1,000 with repayment periods of 14-30 days and higher APRs due to their brief duration.

- Installment Loans: Structured loans repaid over multiple scheduled payments, offering amounts from $500-$5,000 with terms from 3-24 months and more manageable payment sizes compared to single-payment payday loans.

- Title Loans: Secured loans using vehicle titles as collateral, providing higher loan amounts based on vehicle value but risking asset loss if repayment fails.

- Line of Credit Products: Flexible borrowing options allowing access to funds as needed up to an approved limit, with interest charged only on amounts actually used rather than the entire available credit line.

-

Income-Based Loans: Specialized products with repayment structures directly tied to income fluctuations, particularly useful for gig workers, freelancers, or those with variable income patterns.

Parting Thoughts: Choosing the Right Instant Payday Loans Online Guaranteed Approval for Your Needs

Selecting the appropriate instant payday loan with guaranteed approval requires careful consideration of your specific financial situation, repayment capability, and the various lender options available in the 2025 marketplace, balancing the immediate need for funds against the long-term implications of loan terms and costs.

Frequently Asked Questions About No Credit Check Loans Online

How Do Online Loans No Credit Compare to Traditional Banking Options?

Online loans without credit checks offer faster approval and funding than traditional bank loans, providing money within 24 hours versus days or weeks for conventional banking products.

Are Quick No Credit Check Loans Safe for Borrowers with Poor Credit?

Quick no credit check loans can be safe when obtained from licensed, reputable lenders who follow regulatory guidelines and provide transparent terms without hidden fees.

What Documentation Is Required for Loans Online Instant Approval?

Loans with online instant approval require proof of identity, verification of income, bank account statements, and contact information.

How Soon Can I Receive Funds from Easy Online Loans Instant Approval?

Funds from easy online loans with instant approval arrive within one business day after final approval, with some lenders offering same-day funding for applications completed before midday.

What Are the Typical Interest Rates for No Credit Check Loans Guaranteed Approval?

Interest rates for no credit check loans with guaranteed approval range from 5.99% to 35.99% from direct lenders, with some payday and short-term products reaching rates of 200% or higher APR.

Project Name: Pay Day Loans

Media Contact:

Company Website: https://hoverdayltd.com/

Contact Person: Talia Greene

Email: T.greene@hoverdayltd.com

Phone: +1 (800) 424-2789

Disclaimer: This announcement contains general information about Hover Day services and should not be considered financial advice. Hover day services does not guarantee loan approval, and loan terms may vary by applicant and lender requirements. Loans are available to U.S. residents only.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/f5369692-9359-4f3d-a0e9-b3708a23ada2

https://www.globenewswire.com/NewsRoom/AttachmentNg/1250bd8d-42f7-4cbd-8da8-8ab36a2bac51

Distribution channels: Consumer Goods, Media, Advertising & PR

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release