Zevra Files Definitive Proxy Statement and Mails Letter to Stockholders

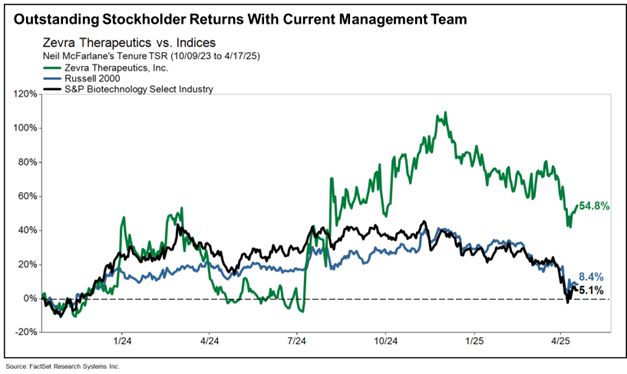

Highlights 54.8% Total Stockholder Return Under Refreshed Board and Management Team

Zevra Continues Growth Trajectory into a Global Commercial Rare Disease Company with Consistent Execution, New Product Launches, and Significant Financial Flexibility to Execute Strategic Plan

Urges Stockholders to Defend Board Independence from Majority Influence by Individual 2.8% Stockholder, Mangless, Who Had Three Nominees Elected to the Board in 2023

Mangless Has Not Detailed any Strategies, Plans, or New Ideas to Improve Zevra’s Business and Appears Solely Focused on Replacing Two Highly Qualified Directors

Board and Management Urge Stockholders to Vote "FOR" Zevra’s Highly-Qualified and Experienced Director Nominees on the WHITE Proxy Card

/EIN News/ -- CELEBRATION, Fla., April 21, 2025 (GLOBE NEWSWIRE) -- Zevra Therapeutics, Inc. (NasdaqGS: ZVRA) (“Zevra”, or “the Company”), a commercial-stage company focused on providing therapies for people living with rare disease, today announced it has filed its definitive proxy statement with the U.S. Securities and Exchange Commission (the “SEC”) in connection with the Company’s 2025 Annual Meeting of Stockholders (“Annual Meeting”), which is scheduled to take place on May 29, 2025. Stockholders of record as of April 4, 2025 will be entitled to vote at the Annual Meeting.

Zevra’s Board of Directors strongly recommends that stockholders vote "FOR" the Company's two highly-qualified directors up for re-election on the WHITE proxy card – Wendy L. Dixon, Ph.D and Tamara A. Favorito, both of whom bring extensive public company board experience and life sciences management expertise to the Zevra Board. Both of these independent directors have contributed valuable perspectives that have helped accelerate the Company’s progress and execution of its strategic goals.

In conjunction with the definitive proxy filing, Zevra is mailing a letter to stockholders detailing the decisive action the Company has taken over the past two years to transform Zevra into a stronger, growth-oriented commercial organization, which is poised to continue to drive significant stockholder value. The letter also addresses the attempt by an individual stockholder, Daniel J. Mangless, to replace two highly qualified directors with his nominees who could disrupt the clear progress underway and jeopardize Zevra’s ability to deliver long-term value for stockholders.

As stockholders consider this important election, it is critical to remember that:

-

The proactive and refreshed Zevra Board and management team have a proven track record of success, as demonstrated by the continued progress and significant stockholder value creation during the last two years. Seven of eight directors have joined the Board since 2023 and Zevra’s refreshed management team has launched two rare disease therapies, rapidly expanded the Company’s commercial capabilities, and positioned its pipeline for continued success.

-

The ongoing execution of Zevra’s strategy is designed to continue driving value over the coming months and years.

-

Zevra’s Board nominees are proven, experienced public company leaders and directors who have the requisite company and industry expertise and fulfill the essential requirements for effective governance of a rapidly growing commercial-stage rare disease company. During their tenure, the Board’s nominees have initiated and overseen substantial improvements to the Company.

- Despite owning just 2.8% of the Company and having already had three nominees elected to the Board in 2023, Mr. Mangless is now actively seeking two additional Board seats without providing any clear strategy or explanation of what he intends to accomplish or how he proposes to increase stockholder value. If Mr. Mangless’ two nominees are elected this year, his nominees would have five Board seats in total, representing a majority of the Board. This latest attempt raises questions about the amount of undue influence one stockholder should have on the Board. In his own proxy filing, Mr. Mangless acknowledges that if his two nominees are elected, the five nominees that he will have added to the Board “will potentially be able to implement any actions that they may believe are necessary...”

-

Mr. Mangless has not disclosed any specific strategies, plans, or new ideas to improve Zevra’s business – in fact, he has expressed agreement with the recent actions that Zevra has taken, including the onboarding of Zevra’s current leadership, yet he still appears focused on replacing two highly-qualified directors with his nominees who lack the necessary expertise, independence, and proper business judgment and acumen to serve Zevra's stockholders effectively. Mr. Mangless’ nominees are a proxy solicitor with no relevant Board or industry experience, and a former CEO, both of whom have previously destroyed significant stockholder value. The Zevra Board believes that adding his nominees will put stockholders‘ investments in Zevra at risk.

-

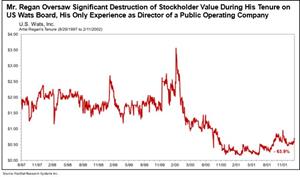

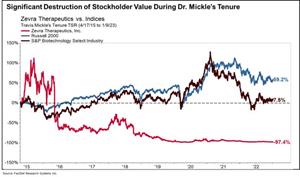

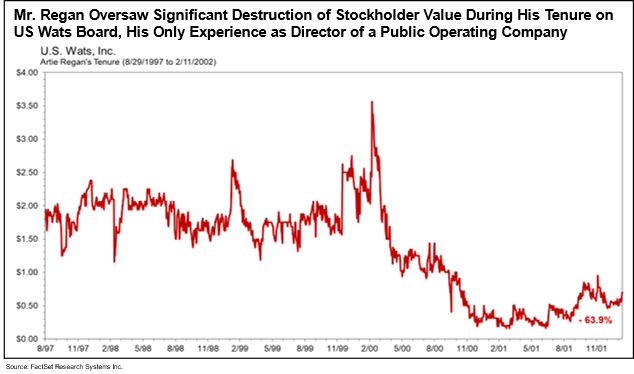

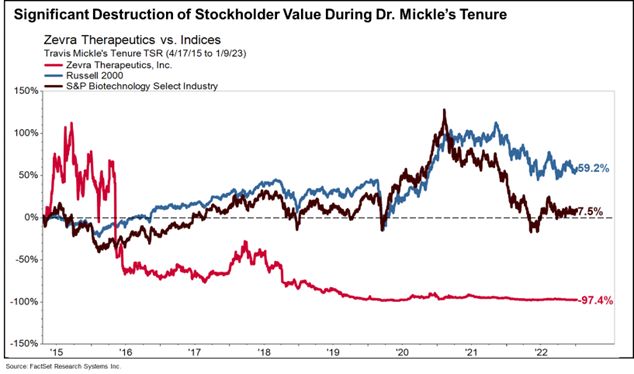

Mr. Mangless’ nominees, Arthur Regan and Dr. Travis Mickle, have track records of destroying stockholder value in public company leadership roles. During Regan’s tenure as a director at US Wats, US Wats’ stock price fell 63.9%. While Dr. Mickle was CEO of Zevra, its stock price plummeted 97.4%.1

Zevra's letter to stockholders and other materials regarding the Board's recommendation for the 2025 Annual Meeting can be found on the Company’s investor relations website at https://investors.zevra.com/.

The full text of the letter follows:

Dear Fellow Stockholders,

The Zevra Board of Directors and management team have taken decisive action over the past two years, transforming the Company and driving significant stockholder value creation.

This transformation began in October 2023, when your Board appointed Neil McFarlane as President and CEO of Zevra, following a thorough process to find the right leader to accelerate Zevra’s progress and harness our pipeline of innovative rare disease therapies. Since then, we have launched two rare disease therapies and have been rapidly expanding Zevra’s commercial capabilities. We completed a comprehensive review of our development pipeline to facilitate investment in the most promising, highest return opportunities. At the same time, we have added significant expertise to support the Company’s growth and help us continue to drive operational excellence across our commercial and pre-commercial programs. Further, we have strengthened Zevra’s balance sheet, providing the Company with ample financial flexibility to continue investing in growth, without needing incremental funding from the capital markets.

In late 2024, your Board and management team detailed a clear and comprehensive five-year strategic plan to drive long-term growth and patient impact. We are making significant progress as we successfully drive towards our clear priorities and achieve our vision of positioning Zevra as a leading global rare disease company.

The results of our execution speak for themselves: Our strategy has enabled Zevra to deliver superior returns for our stockholders. During the last 1-year and 2-year periods, your Board and management team have delivered total stockholder returns of 54.1% and 14.8%, respectively, all in excess of the comparable biotech sector and the Russell 2000. As seen below, since Mr. McFarlane was appointed CEO in October 2023, Zevra has achieved impressive total stockholder returns of 54.8%.2

Against this backdrop of significant commercial progress and superior returns, you have an important decision to make at our upcoming Annual Meeting on May 29, 2025. Your Board has two independent directors up for re-election, Wendy L. Dixon, Ph.D., who has served as a director since April 2023, and Tamara A. Favorito, who has served as a director and Chair of the Audit Committee since August 2021 and as our Board Chair since May 2023. Dr. Dixon and Ms. Favorito bring extensive public company board experience, deep knowledge of Zevra, and life sciences management expertise to the Zevra Board. Both directors have contributed valuable perspectives that have helped accelerate the Company’s progress and execution of its strategic goals.

Meanwhile, Daniel J. Mangless, an individual stockholder, has nominated Travis C. Mickle, Ph.D., Zevra’s former President and CEO, and Arthur C. Regan, a proxy solicitor, for election to your Board. We believe that adding a former CEO, who presided over a period of significant stockholder value destruction during his tenure at Zevra and cannot be considered independent under SEC and stock exchange rules, as well as a proxy solicitor with no industry experience risks significant disruption to Zevra’s ongoing progress and ability to continue delivering sector-leading returns to stockholders. Further, their appointments would distract from the Company’s continued disciplined execution of its five-year strategic plan and value-creation initiatives.

Zevra’s Board recommends that stockholders reject these efforts by Mr. Mangless. Please discard any blue proxy card sent to you by Mr. Mangless.

To elect the Zevra Board's nominees, we encourage you to vote today – no matter how many or how few shares you own –online or by signing and dating the enclosed WHITE proxy card and returning it in the postage-paid envelope provided.

As you consider this important election, it is critical to remember that:

-

Your proactive and refreshed Zevra Board and management team have a proven track record of success, as demonstrated by the continued progress and significant stockholder value creation during the last two years. Seven of eight directors have joined the Board since 2023, and Zevra’s refreshed management team executed the launch of two rare disease therapies, rapidly expanded the Company’s commercial capabilities and positioned its pipeline for continued success.

-

The ongoing execution of Zevra’s strategy is designed to continue driving value over the coming months and years.

-

Zevra’s Board nominees are proven, experienced public company leaders and directors who have the requisite company and industry expertise and fulfill the essential requirements for effective governance of a rapidly growing commercial-stage rare disease company. During their tenure, the Board’s nominees have initiated and overseen substantial improvements to the Company.

- Despite owning just 2.8% of the Company and having already had three nominees elected to the Board in 2023, Mr. Mangless is now actively seeking two additional Board seats without providing any clear strategy or explanation of what he intends to accomplish or how he proposes to increase stockholder value. If Mr. Mangless’ two nominees are elected this year, his nominees would have five Board seats in total, representing a majority of the Board. This latest attempt raises questions about the amount of undue influence one stockholder should have on the Board. In his own proxy filing, Mr. Mangless acknowledges that if his two nominees are elected, the five nominees that he will have added to the Board “will potentially be able to implement any actions that they may believe are necessary...”

-

Mr. Mangless has not disclosed any strategies, plans, or new ideas to improve Zevra’s business – in fact, he has expressed agreement with the recent actions that Zevra has taken, including the onboarding of Zevra’s current leadership, yet he still appears focused on replacing two highly-qualified directors with his nominees who lack the necessary expertise, independence, and proper business judgment and acumen to serve Zevra's stockholders effectively. Mr. Mangless’ nominees are a proxy solicitor with no relevant Board or industry experience, and a former CEO, both of whom have previously destroyed significant stockholder value. The Zevra Board believes that adding his nominees will put stockholders‘ investments in Zevra at risk.

-

Mr. Mangless’ nominees, Arthur Regan and Dr. Travis Mickle, have track records of destroying stockholder value in public company leadership roles. During Regan’s tenure as a director at US Wats, US Wats’ stock price fell 63.9%. While Dr. Mickle was CEO of Zevra, its stock price plummeted 97.4%.3

We ask you a simple question: Would you rather have a proven team with a clear strategy, strong momentum, relevant expertise, and a track record of increasing stockholder value, or risk distraction, disruption, and potential destruction of the Company's value by a single stockholder with unqualified director nominees and no stated business strategy? We urge you to stand with management and reject the blue proxy card with Mr. Mangless’ nominees.

Your Board and Management Team are Actively Delivering Significant Progress as we Continue Zevra’s Transformation into a Leading Rare Disease Company

Over the past two years, your Board and management team have been actively transforming Zevra into a more efficient, more focused organization that is better positioned to create value for our patients and stockholders. In the third quarter of 2024, we introduced our five-year strategic plan, built on four key pillars that have informed our priorities and investments as we continue to accelerate Zevra’s commercial momentum: (1) Commercial Excellence, (2) Pipeline and Innovation, (3) Talent and Culture, and (4) Corporate Foundation.

1. Delivering Commercial Excellence – In 2024, we successfully commercialized and launched Zevra’s first two products. Since then, we have maintained our active focus on driving best-in-class commercial excellence.

- In September 2024, we received approval from the U.S. Food and Drug Administration for MIPLYFFA®, the first approved product in the U.S. for the treatment of Niemann-Pick disease type C (NPC). Alongside this approval, we received a Rare Pediatric Disease Priority Review Voucher (PRV), which Zevra recently sold for $150 million to further enhance our financial flexibility. MIPLYFFA became available to patients within eight weeks following approval, and with the support of the NPC community and strong execution by our team, we were able to quickly ensure a smooth transition for all U.S. Expanded Access Program (EAP) participants to MIPLYFFA as a commercial product.

-

Eight months earlier, in January 2024, we launched OLPRUVA®, Zevra’s first-ever commercial product, for people suffering from certain urea cycle disorders (UCDs), and we have continued its growth while accelerating the establishment of our commercial footprint.

2. Enhancing the Value of Zevra’s Pipeline and Innovation – Throughout 2024, your Board and management team conducted a comprehensive, data-driven review to optimize and curate Zevra’s portfolio. This review allowed us to focus our resources on development projects where Zevra is uniquely positioned to create the most value for patients and our stockholders – ensuring that we are investing in Zevra’s most promising, highest return opportunities.

- Launched Phase 3 DiSCOVER trial: Based on the results of our review, in mid-2024, we reinitiated recruitment for the Phase 3 DiSCOVER trial of celiprolol for the treatment of Vascular Ehlers-Danlos Syndrome (VEDS) as a potential treatment for a patient population with high unmet need.

-

Maximizing the Value of KP1077: In June, we announced positive topline results from our KP1077 Phase 2 trial in idiopathic hypersomnia at the 2024 Annual SLEEP Meeting. At the end of the third quarter, we completed our end-of-Phase 2 meeting. The FDA and Zevra reached alignment on a Phase 3 trial design and indicated that a single pivotal study with appropriate confirmatory evidence would be sufficient to submit a New Drug Application (NDA). As part of our pipeline review, we have determined that the best path forward to maximize the value of KP1077 is to explore strategic alternatives for advancing its clinical development and future commercialization.

3. Optimizing Leadership Team with the Right Talent: As we have continued our momentum, we have also evolved our leadership team to ensure we have the right talent to support our continued growth into a leading rare disease commercial company.

- In June 2024, we enhanced our executive leadership team with the appointments of Rahsaan Thompson as Chief Legal Officer, Secretary and Compliance Officer, and Alison Peters as Chief People Officer; we also consolidated our development and scientific functions under Adrian Quartel, our Chief Medical Officer.

4. Strengthening Zevra’s Corporate Foundation: We have continued our approach of disciplined capital allocation, focusing our investments on the highest return activities and actively enhancing our financial flexibility.

- In April 2024, we bolstered Zevra’s balance sheet by restructuring the Company’s debt, using a new credit facility provided by premier biotech investors.

- In September 2024, we secured a Rare Pediatric Disease Priority Review Voucher (PRV) with the approval of MIPLYFFA, which we sold this April for approximately $150 million, providing additional non-dilutive capital to fuel our commercial launches of MIPLYFFA and OLPRUVA, and further the development of celiprolol. We believe this transaction provides us with important financial flexibility to deliver on our strategic plan without undue reliance on incremental funding from the capital markets.

In the coming quarters, your Board and management team intend to maintain focus on accelerating Zevra’s momentum – continuing to drive value for both rare disease patients and our stockholders.

Your Board and Management Team Have a Clear Path Forward to Continue Zevra’s Momentum

Looking ahead, we have a clear strategic plan and path forward to continue Zevra’s growth trajectory and realize our bright future. Our priorities in the coming year include:

- Expanding adoption of MIPLYFFA. We are actively focused on increasing awareness and adoption of MIPLYFFA. Most recently, in February 2025, we launched efforts to provide integral educational and testing resources to NPC treatment teams and physicians in the U.S. Our market access team is also working tirelessly to continuously engage with payors to formalize coverage so that all patients may have access to this life-changing treatment.

- Securing regulatory approval of MIPLYFFA in the EU. We remain on track to file a marketing authorization application (MAA) in the second half of 2025. This approval would further expand our addressable market to the estimated 1,100 people living with NPC in the EU.

- Expanding adoption of OLPRUVA for the adult-onset population for whom OLPRUVA's portability and ease of administration may be most beneficial. Our efforts are also focused on supporting patients facing insurance coverage challenges.

- Accelerating enrollment in the Phase 3 DiSCOVER trial for celiprolol, by expanding our outreach and education efforts within the patient community and among treating physicians. Accelerating enrollment and completion of the Phase 3 trial will advance efforts towards making this potential treatment available. There are currently no treatments approved in the U.S. for VEDS and the approximately 7,500 people living with this disease.

With a strong pipeline of innovative products, multiple upcoming milestones in the coming quarters, and your management team’s continued disciplined execution, we are confident that Zevra is positioned for long-term success.

Your Board and Management Team Already Have Fresh Perspectives to Drive Stockholder Value

The Zevra Board and management team have been dramatically refreshed since 2023. Seven out of the eight current directors joined the Board in the past two years. Since his appointment as President and CEO in October 2023, Mr. McFarlane’s leadership has delivered significant stockholder value creation. Since then, we have added more talent and expertise to support Zevra’s continued growth, as evidenced by our June 2024 executive appointments.

Your Board is composed of directors who are exceptionally qualified, independent, and committed to acting in the best interests of all Zevra stockholders. They provide rigorous oversight of the Company's progress, and we are confident they are the right directors to continue driving superior stockholder value.

With the re-election of the two directors your Board has nominated, Dr. Dixon and Ms. Favorito, your Board would continue to be comprised of eight highly-qualified directors, seven of whom are independent and all of whom bring important perspectives and expertise to oversee the continued execution of Zevra’s strategy.

We Actively Engaged with Mangless to Try to Avoid a Costly, Potentially Distracting Proxy Contest – Yet He is Intent on Replacing Two Highly-Qualified Directors

Over the past several months, we have actively engaged with Mr. Mangless in an attempt to avoid a costly proxy contest that could distract from our continued strong execution. Despite his 2.8% ownership of the Company and having already had three of his nominees elected to the Board in 2023, Mr. Mangless appears intent on trying to secure two additional seats on the Board without providing any specific strategy or plan to meaningfully improve Zevra’s business. Mr. Mangless only expresses dissatisfaction with the Company’s governance structure, without disclosing any expertise or experience regarding the corporate governance practices that are typical for companies of similar size, stage, and/or therapeutic focus to Zevra.

Mr. Mangless’ proxy states that he previously shared suggestions about “increasing the diversity of the Board,” but has not described how either of the candidates he has nominated would promote diversity or otherwise align with his own suggestion.

As a company dedicated to developing breakthrough therapies for rare diseases, we operate in a highly specialized and complex environment. Success for stockholders, employees, and the patients we help requires an experienced Board with an appropriate mix of perspectives, including deep scientific and commercial expertise, regulatory acumen, financial experience, and the ability to oversee a long-term vision.

Despite the significant and recent Board refreshment at Zevra, Mr. Mangless is actively trying to replace two highly-qualified directors who bring valuable industry, operational, and financial expertise to the Board, both of whom have substantial experience in leadership roles and as public company directors:

Wendy L. Dixon, Ph.D., has served as a director since April 2023 and is a member of the Company’s Audit Committee. Dr. Dixon has more than 40 years of biopharmaceutical industry experience in drug development, with leadership roles in regulatory affairs and commercial capabilities. Dr. Dixon has held a number of leadership roles at leading publicly-traded companies, including serving as Chief Marketing Officer and President of Global Marketing at Bristol-Myers Squibb, senior Vice President of Marketing at Merck, and executive management positions at West Pharmaceuticals, Osteotech, and Centocor, in addition to roles at SmithKline and French (now GlaxoSmithKline) in marketing, regulatory affairs, project management, and as a biochemist.

Tamara A. Favorito has served as a director and Chair of the Audit Committee since August 2021, and as our Board Chair since May 2023. Ms. Favorito has more than 30 years of industry experience, including 20 years as a Chief Financial Officer for multiple publicly-traded life science companies, including Immunic, Inc., Signal Genetics, Inc. (now Viridian Therapeutics, Inc.), and Favrille, Inc. (now MMR Global, Inc.). Ms. Favorito is the only director who was on the Board prior to 2023, giving her a deeper understanding of the Company’s history and an important perspective as the Company continues its path forward.

Mangless’ Proposal to Add a Proxy Solicitor and a Former CEO with Value-Destructive Track Records Meaningfully Risks Disruption to Zevra’s Continued Execution of its Strategic Plan

Mr. Mangless is proposing to replace two of your highly-qualified directors with his two nominees. Neither of Mr. Mangless’ nominees would bring any additive skills or experience to the Board.

We have significant concerns about the potential disruption and distraction Mr. Mangless’ nominees could bring to Zevra’s operations. More specifically:

- Mr. Mangless’ nominee, Mr. Regan, runs a five-person proxy solicitation firm, has no industry experience or expertise in life sciences, and is distinctly ill-suited to serve as a director of a leading commercial rare disease company like Zevra. Mr. Regan's only experience as a director of a public operating company was over 25 years ago at US Wats, Inc. (“US Wats”), a telecommunications company where he served as corporate secretary and director. As of April 2000, subsequent to a merger, US Wats appears to have abruptly ceased complying with its reporting requirements, a responsibility that seems directly tied to Mr. Regan as the company’s corporate secretary and director at that time, and the company’s SEC registration was subsequently revoked. Furthermore, during Mr. Regan’s tenure as a director, US Wats stockholder value was destroyed, with the stock price falling 63.9%.

- Mr. Regan’s only other public company director-level experience appears to have taken place for a little over a year starting in 2017, when he was nominated by an activist investor as a trustee of a closed-end mutual fund, Madison Strategic Sector Premium Fund. During that contested election, Mr. Regan was also performing proxy solicitation services for the activist, leading independent proxy advisor Glass Lewis to determine during the proxy contest that “we see very little value in the prospective election of...Mr. Regan.” On August 22, 2017, Madison Strategic Sector Premium Fund held an Annual Meeting of stockholders of the fund, at which Mr. Regan was elected as a trustee. By October 2018, Madison Strategic Sector Premium Fund merged with another fund, deregistered from the SEC and delisted from the stock exchange on which it had been listed.

- Mr. Regan is inexperienced and wholly unqualified to serve as a director of a highly specialized rare disease company like Zevra. Specifically, we believe that Mr. Regan’s erratic and arguably unprofessional nature, evident in his communications on his personal blog and online posts, would create serious risk to Zevra’s reputation, performance, and momentum if he were elected to the Board.

- Mr. Mangless has also nominated Dr. Mickle, who cannot be considered independent under SEC and stock exchange rules due to his former roles as CEO and President of the Company until his resignation in 2023 and his consulting arrangement with the Company until 2024. While our current management team has delivered a strong 54.8% total stockholder return, Dr. Mickle's leadership led to stockholder value destruction at Zevra – resulting in the share price plummeting 97.4% during his tenure, substantially underperforming both industry benchmarks and the broader market.

- Further, it would be highly unusual for a former CEO to serve as a director of that same company, so soon after departing as CEO. This could create a scenario where Dr. Mickle seeks to micromanage the executive team instead of focusing on oversight, or even to pursue a return to his previous role as CEO. We view this potential outcome as negative to Zevra and its stockholders, especially given the substantial increase in stockholder value delivered by the current management team, as compared to the destruction of stockholder value under Dr. Mickle’s leadership.

Your Board and management team believe the addition of one or both of Mr. Mangless’ nominees would distract from management's continued successful execution of our strategic plan. In the absence of any stated strategy or ideas for increasing stockholder value, we believe Mr. Mangless and his nominees will only disrupt the clear progress underway and risk our ability to deliver short- and long-term value for you.

PROTECT THE VALUE OF YOUR INVESTMENT IN ZEVRA:

VOTE THE WHITE PROXY CARD TODAY

Your Board and management team have a clear path forward to continue delivering value for all Zevra stockholders as we advance the Company’s transformation into a leading rare disease company. Your refreshed Zevra Board is active, engaged, and delivering results. Our delivery of significant stock price appreciation, strong execution, and operational successes demonstrate that we have the right leadership team and strategic vision in place. Maintaining this momentum is critical to Zevra's continued transformation into a leading rare disease company and to our continued efforts in delivering sustained value for you, our valued stockholders.

Whether or not you plan to attend the Annual Meeting, you have an opportunity to protect your investment in Zevra by voting the WHITE proxy card. Your vote is extremely important, no matter how many or how few shares you own. We urge you to vote today, either online or by signing and dating the enclosed WHITE proxy card and returning it in the postage-paid envelope provided. The Board strongly urges you to discard and not to sign or return any blue proxy card sent to you by Mr. Mangless.

This is an important moment for Zevra’s future, and we hope we can count on your support. For all of the reasons we have outlined, we encourage you to vote on the WHITE proxy card "FOR" the re-election of Wendy Dixon, Ph.D. and Tamara A. Favorito to the Company’s Board as Class I directors to hold office until the 2028 Annual Meeting of Stockholders.

We are excited about the opportunities ahead for Zevra. Thank you for your continued support.

Sincerely,

The Zevra Board of Directors

About Zevra Therapeutics, Inc.

Zevra Therapeutics, Inc. is a commercial-stage company combining science, data, and patient need to create transformational therapies for rare diseases with limited or no treatment options. Our mission is to bring life-changing therapeutics to people living with rare diseases. With unique, data-driven development and commercialization strategies, the Company is overcoming complex drug development challenges to make new therapies available to the rare disease community.

For more information, please visit www.zevra.com or follow us on X and LinkedIn.

Cautionary Note Concerning Forward-Looking Statements

This press release may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that do not relate solely to historical or current facts, including without limitation statements regarding the Company’s actions to enhance stockholder value, the Company’s plans with respect to director candidates nominated by stockholders; the Company’s strategic, financial, operational, and product development objectives; and the timing of any of the foregoing. Forward-looking statements are based on information currently available to Zevra and its current plans or expectations. They are subject to several known and unknown uncertainties, risks, and other important factors that may cause our actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements, as described in detail in the "Risk Factors" section of Zevra’s Annual Report on Form 10-K for the year ended December 31, 2024, and Zevra’s other filings with the SEC. While we may elect to update such forward-looking statements at some point in the future, except as required by law, we disclaim any obligation to do so, even if subsequent events cause our views to change. Although we believe the expectations reflected in such forward-looking statements are reasonable, we cannot assure that such expectations will prove correct. These forward-looking statements should not be relied upon as representing our views as of any date after the date of this press release.

Additional Information and Where to Find It

Zevra has filed with the SEC a definitive proxy statement on Schedule 14A, containing a form of WHITE proxy card, with respect to its solicitation of proxies for the 2025 Annual Meeting of Stockholders.

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) FILED BY ZEVRA, AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED BY ZEVRA WITH THE SEC WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT ANY SOLICITATION.

Investors and security holders may obtain copies of these documents and other documents filed with the SEC by Zevra free of charge through the website maintained by the SEC at www.sec.gov. Copies of the documents filed by Zevra are also available free of charge by accessing Zevra’s investor relations website at investors.zevra.com.

Participants in the Solicitation

Zevra, its directors, executive officers, and employees may be deemed to be participants in the solicitation of proxies with respect to a solicitation by Zevra. Information about Zevra’s executive officers and directors is available under the heading “Information about our Executive Officers and Directors” in Part I of Zevra’s Annual Report on Form 10-K for the year ended December 31, 2024, which was filed with the SEC on March 12, 2025 and under the headings “Proposal 1: Election of Directors,” “Executive Officers,” “Security Ownership of Certain Beneficial Owners and Management” and “Executive Compensation,” and “Director Compensation” in Zevra’s definitive proxy statement on Schedule 14A for its annual meeting of stockholders held in 2025, which was filed with the SEC on April 21, 2025. To the extent holdings of our directors and executive officers of Zevra securities reported in such definitive proxy statement change, such changes will be reflected on Statements of Change in Ownership on Forms 3, 4 or 5 filed with the SEC. These documents are available free of charge at the SEC’s website at www.sec.gov. Copies of the documents are also available free of charge by accessing Zevra’s investor relations website at investors.zevra.com.

Contacts

For investor inquiries

Nichol Ochsner

+1 (732) 754-2545

nochsner@zevra.com

For media inquiries

FTI Consulting

Tanner Kaufman / Kyla MacLennan / Mike Gaudreau

zevratherapeutics@fticonsulting.com

1 Source: FactSet Research Systems Inc.

2 Source: FactSet Research Systems Inc. as of 4/17/25

3 Source: FactSet Research Systems Inc.

Photos accompanying this announcement are available at https://www.globenewswire.com/NewsRoom/AttachmentNg/6d5679f5-0a5d-493b-b14b-3c2f48df6987

https://www.globenewswire.com/NewsRoom/AttachmentNg/ce75ec49-2edd-4b5e-b286-a2dc3de3a0d9

https://www.globenewswire.com/NewsRoom/AttachmentNg/e861f5be-f8ec-4a72-a9cf-f736c0847ee9

https://www.globenewswire.com/NewsRoom/AttachmentNg/edf0ce9f-f81b-4444-9d54-36c2be2ea69d

https://www.globenewswire.com/NewsRoom/AttachmentNg/011661ce-8fcf-4fc4-937a-a2bc1f608cc7

Outstanding Stockholder Returns with Current Zevra Management Team

Outstanding Stockholder Returns with Current Zevra Management Team

Wendy L. Dixon, Ph.D.

Wendy L. Dixon, Ph.D.

Tamara A. Favorito

Tamara A. Favorito

Mr. Regan Oversaw Significant Destruction of Stockholder Value During His Tenure on US Wats Board

Mr. Regan Oversaw Significant Destruction of Stockholder Value During His Tenure on US Wats Board

Significant Destruction of Stockholder Value During Dr. Mickle’s Tenure

Significant Destruction of Stockholder Value During Dr. Mickle’s Tenure

Distribution channels: Companies, Healthcare & Pharmaceuticals Industry ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release