Market Briefing For Monday, April 7

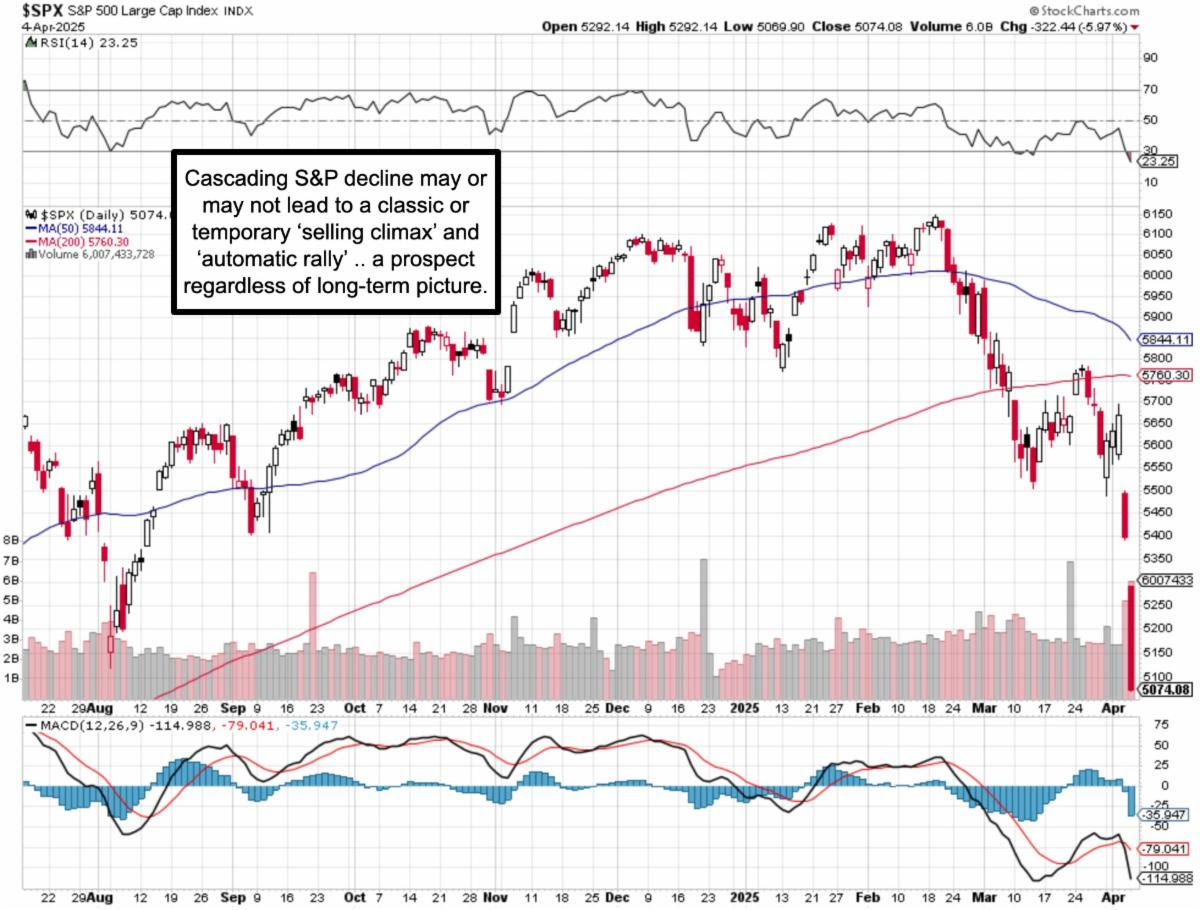

A fog of policy-based shocks can be pierced if one thinks ahead, with an idea of how it can play-out, with intended favorable, or disastrous, outcomes. We don't know the weekend; we don't know what the EU will or won't do (and in a sense means more than China to us); and we don't know Iran/geopolitical risks that seem to be sidelined. We do know the history of culminating 'panics' with a climactic washout and reversal. If this was 50 years ago I'd suggest a low by 10:30 am ET on Tuesday; but this is not that clear a set-up situation.

I do think (if there's nothing to prevent more panic, as that's unknown) we will get a snap-back that at least be a play for VIX spiking higher then dropping. I also think global trade is being 'rewired' plus worry about a big refunding. So, it's reasonable for most people to stand aside, especially multinationals given a 'growth scare' ... except we've been warning about those big-caps for ages.

This is 'supposed' to give us a solid foundation for economic growth; however that's not how it appears to the majority of people so far. Interest rates decline somewhat; people losing their jobs concurrently however; with the greater risk being that something like 10% of the society financially holds-up much of the rest. The psyche of investors has been dinged, and you could sense that just from the President's 'Tweet' to Powell asking for a rate cut, which of course he wouldn't do at a speaking event; nor without more data evidence (inflation).

If this is a 'controlled burn' (Kyle Bass called it that); and not a Palisades fire; then it ought to work to a low; but maybe not a classic climactic bottom yet; simply because primary victims in the market are the normally stoic big-caps. And fortunately we urged 'not' chasing those for months; even pre-Trump.

Mostly askance from economic policies (on the surface), look at Microsoft's move Friday. While AI / software booms remind of American Exceptionalism; there is serious stuff coming-out of China; digitally and military sabre-rattling; and we do see 'at this point' Microsoft being first to retrench a bit.

I know that I have suggested that 'data analytics' and Quantum Computing, over time, will erode the demand for huge data-centers and older-era chips, but this is a bit of a hint that at least one mega-cap envisions the same, and that may not be pleasing to Nvidia; but Microsoft has a Quantum plan too.

At the same time, Microsoft nudged media to publicize their Ai / Chat service (Co-Pilot etc.) and limited talking about the other delays..which may be good as far as an approach, since I agree about excessive bigger data-centers. Of course they focused on the big-shift to Ai accelerators, which makes sense. I congratulate the 50 years since Bill Gates bought Seattle Computer Works which actually developed the original basic software:). (Recall: I believe Bill paid $25,000. for that; before he pitched IBM in Boca. I met him briefly once in Vegas ahead of his CES Keynote; before being rushed away by a German Shepherd on a leash with an FBI Agent ... why did he get FBI for security? .. )

What did they do that nobody notices amid the economic/tariff chaos? Well, they slowed build-out plans for data-centers, use of high-performance chips, and talked about slower demand for AI. I don't think that's valid; but suspect it's because they 'do' have a Quantum chip, and realize existing processors become legacy as time evolves. And it won't be many years either.

Market X-ray: our slowdown has a knock-on effect on China, which probably is why Trump mistakenly thought Beijing would not respond as heavily ... well perhaps Trump is playing Chess..but Xi is playing 4D chess ... who knows.

There's plenty of liquidity around; so I'm not worried (at this point) about 'credit default swaps' moving a bit. The Fed is 'sort of' quantitatively tightening; so it's a short-term imbalance, but may put us in a better fiscal position late this year.

The Fed has reduced their Balance Sheet (desired for two years .. about 25% so far); but that's not accomodative, as such. Bond yields under 4% probably is a Trump goal; but not by wrecking American (and global) economics; or just perhaps that actually was intended ... presumably not on behalf of Russia.

In any event, no analogy with Nero fiddling while Rome burned; but Trump did go to play Golf Friday afternoon, probably negotiating trade deals on the 19th hole. (Of course there is no 19th hole, other than the Club's bar and grill..). Of course that may be fine, if he knows there will be 'off-ramps' to this next week.

Of course assuming he 'wants' an off-ramp; not simply lower interest rates as well as a more-isolated United States in this world, closer to the 1930's scene that included trade restraint, animosities; we know where that led the world.

Economic headwinds will persist. Mitigating the impact depends largely on the source of goods (hence cost of goods), rather than just consumer demand for goods. High duties across the board exist for most multinational companies. It is normal for most businesses involved in re-shorting to be concerned; again it is not an area we're suggesting at all; including Footwear, which was the first sector I forewarned about outsourcing risks, starting in an earlier globalist era.

So now we have what is called 'Reverse Nixon' policy implementation. Very complicated to delve into, tried a bit over the last couple reports, but realize it is more about Washington 'replacing taxes with tariffs', plus getting lower interest rates. It's a domestic goal that envisions the combination offsetting a trend toward higher consumer goods pricing, and they won't sidestep that, of course other than severe recession or depression that brings it all way down.

A lot of responses companies can do with regard to tariffs, is increase prices for the most part. You will also crush the psyche and decrease demand; so it's got to be more than Ford that offers 'employee pricing' for two months (great marketing gimmick; but they won't be profitable doing that for much longer). If there is a Trump Put, that's uncertain, as stubbornness needs to moderate.

Of course there's the 'Treasury issuance' later this year; essentially the large refunding that needs interest rates at lower levels. This addresses that?

We are getting past the implementation stage; and probably causes 'freezing' of a lot of plans by companies (even consumers) as a way forward isn't clear. If this situation goes the way the President wants (which on the surface really is opposed to how he campaigned 'for' the average American, who's suffering under these 'anti-business' 'pro-inflation' and anti-alliance policies) .. however if it goes his way it will still take years to rebuild trust with our partners/friends.

At one point it was fair to say one didn't like the methodology (bullying) of his way of implementing policies; while sharing the goals of growing America. At the same time the bludgeoning approach was too 'in your face' for all partners around the globe, it was also distorted (manufactured tariffs from some others were giving impressions of U.S. goods being charged more than actually was the case; some of that has come out in media in the past day)... now hints of some deals, such as with Vietnam, seem to be evolving. We need more deals like are being discussed, and the market would like to have that by Monday.

At the same time, keep in mind 'crashes' tend to come after a rough period in the market, or Dollar, or economy; and this one is a bit different in-that it was created by policies, regardless of the underlying Debt issue that preexisted. I do think there are signs, nevertheless, that this could be near a completion; at the same time better visibility won't quickly heal the damage inflicted. But yes, I do expect 'some' deals, 'tax proposals', lower interest rates (not quite yet) as well as perhaps something with China, since they played hardball with Trump, even though he seems to have been surprised. So, a TikTok deal pending to assuage concerns? Hard to say; and China never said they'd agree to a sale.

Also, Oil prices have tumbled, and as noted the other, not coincidental OPEC increased production levels etc. Lower Oil, lower taxes, higher tariffs... all part of the plan, which obvious is being delivered with more Pain than preliminarily promised by Trump, who said there would be pain. He doesn't want to cripple American's pension and IRA funds, so probably this outcome gets his respect.

Bottom line: keep your helmets on, while prepared to leave the trenches with aggression, 'if' certain key trading relationships miraculously get reestablished over the weekend. That's unlikely; so in-event the market plummets lower, just remember 'crashes' tend to be culminate a period of decline, not initiate one.

There is a huge caveat, primarily for so-called blue-chip big-caps. That's what seriously is a multiple contraction or even maintenance, but with lower growth or earnings, due to loss of international business. Many times I've note about 40% of revenue (on average) of multinational companies comes from abroad; so of course that matters for 'their' outcomes, even if domestic conditions will improve for companies mostly operating with domestic-generated revenue.

The battlefield is crowded, and forces disjointed on both sides. Hence how hard it comes out is fundamentally unclear. We are not cavalier about it; but avoided virtually all the mega-caps during the frenetic phase of overpricing last year as well as early this year. So while some of our domestic tickers are hit too; we're more confident about their recovery; some of them independent of the market.

One more word . . media talking heads trot-out all the 'hiding places to buy'. I think that's ridiculous 'after' a heavy and multi-month decline. They were very strong on mega-cap techs when it was actually time to unwind such stocks to be careful. Now when others are in panic, it might be time to be a bit stronger but in domestic-centric stocks. Although a rebound will briefly carry most to a higher near-term level, just because funds will probably try reinforcing already retained stocks. The talk about preservation of capital is a bit tardy for them; I'm not against that of course; just saying the horse already left the barn.

Old saying: 'fade Euphoria, and buy Despair'. Are we nearly there?

Rest over the weekend, and we'll tackle Monday.

More By This Author:

Market Briefing For Monday, March 24

Market Briefing For Monday, March 17

Market Briefing For Monday, March 10