You might be interested in

Energy

GOT GAS: Renewables are the lowest cost source of electricity and that’s a plus for green hydrogen

Energy

PH2 successfully produces hydrogen, graphene powder from commercial demonstration plant

Energy

Experts

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

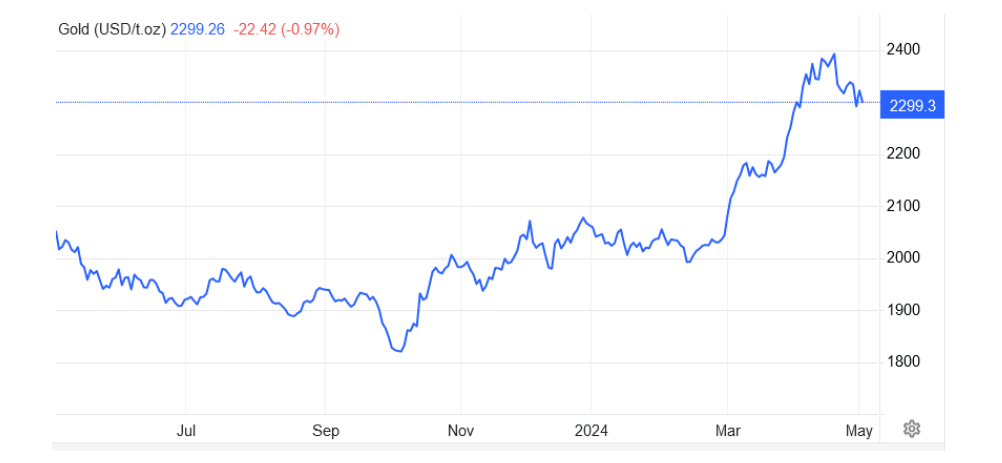

Gold is off just under US$30 over the last seven days of trading and is hovering around US$2,295/ounce (figure 1) representing a four-week low as investors assess the FOMC meeting earlier last week with Chairman Jerome Powell indicating that interest rates were unlikely to change in the foreseeable future.

Easing tensions in the Middle East, persistent inflation and a stronger than expected US economy have all weighed on the gold price.

Platinum fared better, up US$44 over the week rebounding from US$900/ounce a week earlier in response to job cuts and anticipated mine closures for Impala Platinum which the World Platinum Investment Council believe will result in an average annual deficit of 500,000 ounces through to 2028.

Palladium continues to come under heavy selling pressure and finished at US$936.50/ounce down US$50 over the last seven days.

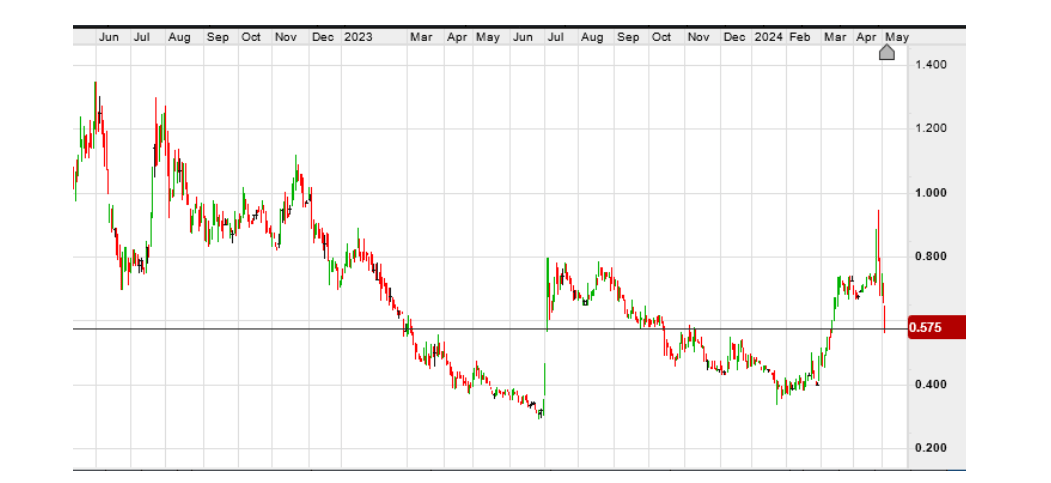

Copper prices (figure 2) dropped back to US$4.5/lb per pound, after reaching a two-year high of US$4.70/lb In late April.

Recent soft manufacturing data from the US showed that factory activity contracted in April.

The big news last week (other than American West Metals (ASX:AW1) getting back on the ground in Canada last week) was BHP’s seemingly unsuccessful swing at Anglo American.

We are starting to also see an increase in activity on the junior end including a back door listing and $6 million capital raising in Mongolian copper explorer Asian Battery Minerals (ASX:AZ9) which is being backed into the old Doriemus (ASX:DOR) shell. Previous exploration has returned some interesting intercepts including 73 metres @ 0.59% Cu and 0.42% nickel from 172 metres downhole.

Unfortunately, the old Doriemus couldn’t replicate the form of that magnificent pony that won the Caufield and Melbourne Cups back in 1995.

I think this is the first of many copper financings on ASX including a wave of Australian explorers having a big swing in Canada; this includes Tempus Resources (ASX:TMR) that recently announced its proposed acquisition of unlisted explorer Somerset Minerals that has acquired a large landing west of AW1 in the Nunavut region of northern Canada.

There hasn’t been much joy on the nickel front in the last couple of years with the most recent casualty being First Quantum Minerals’ Ravensthorpe nickel mine that recently announced the mine was going on care and maintenance with the loss of 530 jobs.

With the nickel laterite producers under pressure as nickel (figure 3) drifted to under US$16,000/tonne, the price has recovered to just under US$18,800.tonne.

The one bright spot however was the news that Ardea Resources (ASX:ARL) (figure 4) has formed a 50:50 incorporated joint venture with Sumitomo Metal Mining Co and Mitsubishi Corporation to form a 50:50 incorporated joint venture to develop the Kalgoorlie Nickel Project – Goongarrie Hub through to a Definitive Feasibility Study and hopefully production depending on the outcomes of this study.

I have been following this story for decades, around about the time that colour television arrived in the great State of Western Australia, so let’s hope that this project, which has been studied more times than the Holy Shroud of Turin, can finally get off the ground.

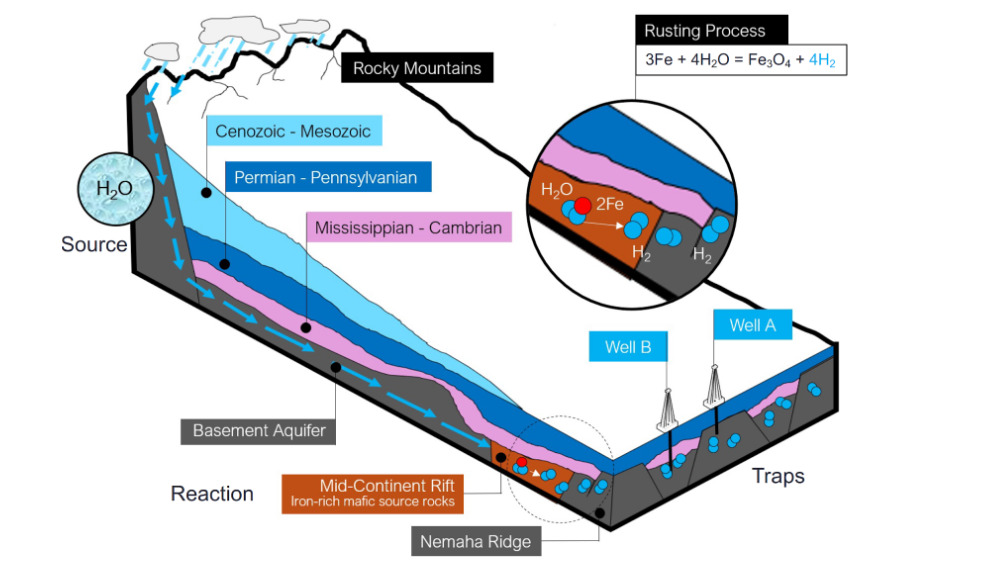

I haven’t been a huge fan of the hydrogen story given how difficult it is to store and transport hydrogen. It took some convincing, however the white hydrogen story could have serious legs.

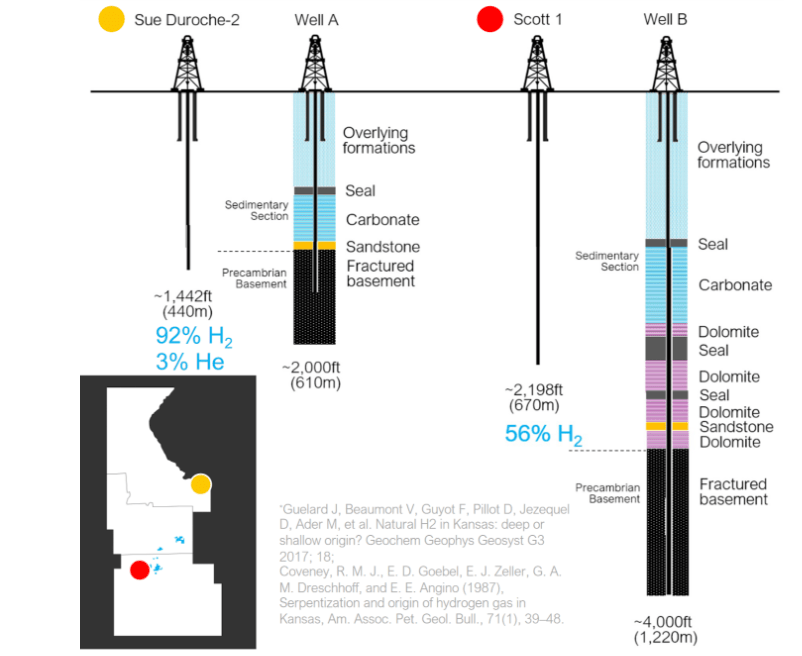

White hydrogen is hydrogen generated via the reaction between iron rich rocks and water (below) and is captured similar to hydrocarbons (figure 6).

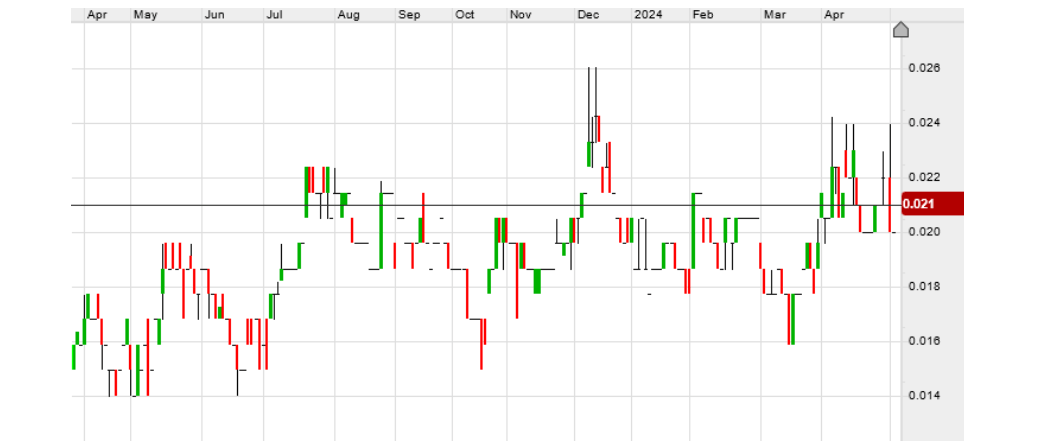

According to the luminaries at Hannam Partners in London, HyTerra (ASX:HYT) (figure 5), led by ex-Shell/Woodside Petroleum geologist Ben Mee, is a standout play and one of the few explorers with projects in Kansas and Nebraska.

HyTerra is proposing (figure 7) to spend ~$2m drilling two holes in the 2nd–3rd Quarter this year and is looking to prove up commercial quantities of natural hydrogen and helium.

One of the key selling points on their 9,600-acre, 100% tenement is that there are over 10 occurrences within the region containing up to 92% hydrogen and 3% helium (figure 9).

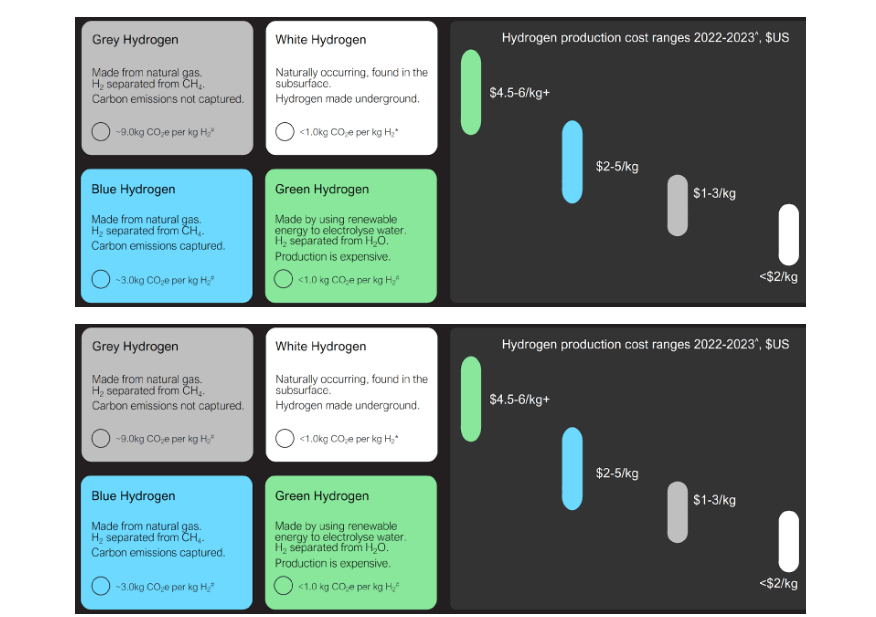

Ben Mee’s business model thesis is that the lowest cost molecule wins every day. White hydrogen has a low-cost profile (figure 8) compared to other forms of hydrogen.

Another big selling point is the concentration of agriculture and manufacturing industries connected by railway and roads.

Potential off-takers nearby include ethanol and ammonia manufacturers, and petrochemical plants with good inter-connectivity via via railways, roads, and/or pipelines.

Based on 50% H2 concentrations, Hyterra sees a break-even or levelised cost of hydrogen of US$2.2/kg (US$5.1/mcf) but we see the potential to reach around US$1/kg.

Key to these strong economics is high hydrogen concentrations similar to those drilled already within HyTerra’s leases, low well costs and high flow rates, all of which we see as possible on HyTerra’s Kansas acreage.

The Stockhead faithful will be pleased to know that the luminaries here at RM Corporate Finance were the vendors, along with Thomas Abraham James and Neil Herbet of Pulsar Helium (PLSR.V) which listed on TSX-V last year and rocketed from 19 cents post listing (from a 30-cent float) to a high last month of C$1.70/share after reporting helium values in excess of 13% at its Minnesota project.

Flow testing is scheduled to commence the month. So, this is very good karma for Hyterra.

Kansas appears to have good provenance for hydrogen and has seen the greatest level of natural hydrogen exploration activity globally and was among the first areas where it was targeted.

Historical drilling at Hyterra’s property has returned hydrogen concentrations up to 92% and helium up to 3%.

Sproule estimates a P50 net unrisked prospective hydrogen resource of 100bcf and helium of 0.5bcf for HYT’s first phase of approximately 10,000 acres.

As the Stockhead know, there are key ingredients required for success in the mining and exploration game; low operating costs, low capital intensity, strong commodity price outlook, excellent logistics and leverage to success.

With South Australian hydrogen explorer Gold Hydrogen (ASX:GHY) trading at a market capitalisation of $250 million it looks like the sector has the wind in its sails… or maybe hydrogen?

At an enterprise value of around $14 million at 2.1 cents following the recently completed $6.2m placement + rights issue at 1.8 cents underwritten by – you guessed it – RM Corporate Finance, it looks like the stock has plenty of room to move as exploration ramps up over CY 2024.

The private US hydrogen sector is also firing up with some chunky capital raisings including Koloma that recently raised US$245 million from investors including Amazon and Bill Gates.

Obviously a confirmed Elvis sighting (from a credible source) really seals the deal for me. And he did perform in Kansas five times (from 1956 to 1977) so there is every reason to believe he will make another appearance around the time of the first hole spudding.

As the great man would say, “It’s Now or Never” for Hyterra and I can feel a Hydrogen (+/- Helium) bomb going off under this share price mid–year.

Well, that’s alright mama.

Guy Le Page is a director and responsible executive at Perth-based financial services provider RM Corporate Finance. A former geologist and experienced stockbroker, he is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States.